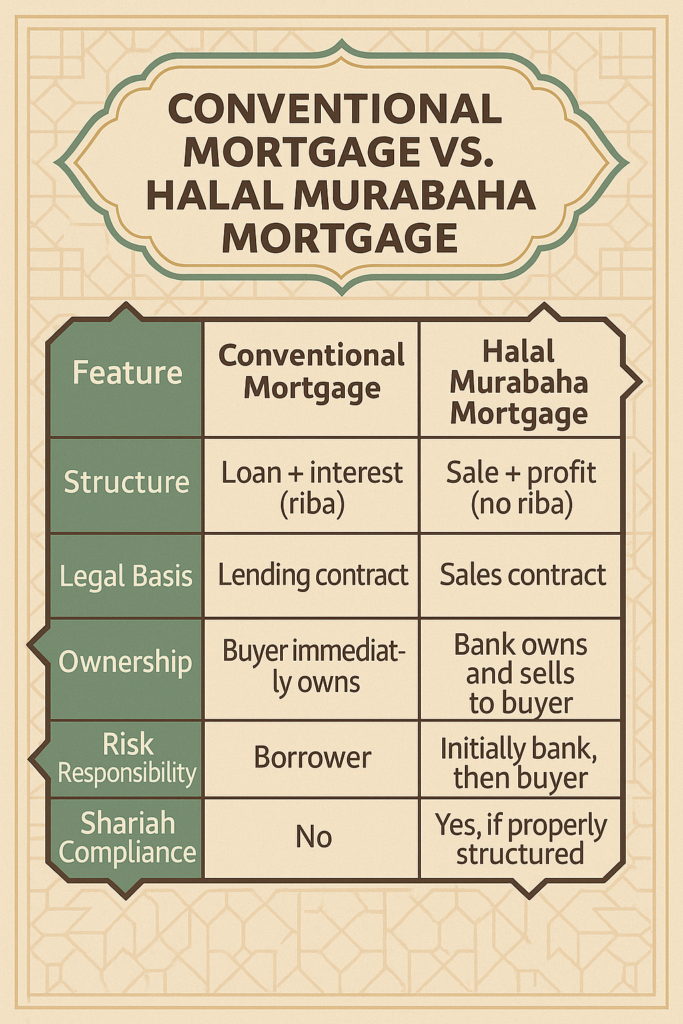

There is a difference between a halal Murabaha mortgage and a conventional mortgage, both in structure and underlying principles.

1. Fundamental Basis

Conventional Mortgage: Involves a loan with interest (riba). The bank lends you money to buy a house, and you repay it with interest over time.

Murabaha Mortgage: Based on Islamic finance principles that prohibit interest. Instead of lending money, the bank buys the property first and then sells it to you at a profit with a fixed markup. You pay in installments.

2. Ownership and Risk

Conventional: You immediately own the house, and the bank secures its interest with a lien. The bank does not share in the risk beyond collateral.

Murabaha: The bank technically owns the home briefly and sells it to you. In proper Murabaha, the bank bears the risk during its period of ownership (even if brief).

3. Profit vs. Interest

Conventional: Charges interest, which compounds and may fluctuate (in variable-rate loans).

Murabaha: The markup is fixed and agreed upon upfront. It’s considered a permissible profit, not riba.

4. Contractual Form

Conventional: A loan agreement with an interest clause.

Murabaha: A sale contract (Bay’ al-Murabaha), not a loan.

5. Ethical Oversight

Conventional: No religious oversight; purely profit-driven.

Murabaha: Must be approved by a Shariah board to ensure it meets Islamic legal and ethical standards.

Allah knows best